Leading Wealth Educator, Jason M. Roll Presents...

What Does A Debt-Free and Tax-Free Retirement Look Like For You?

We Have Solutions!

Are You 100% Sure You Are Going To Have A Great Retirement Or Do You Have Doubt? Are Retirement Risks Holding You Back?

CAPITAL RISKS:

The risk of not having enough available capital, for contributions, in order to achieve your retirement goals.

74% of your retirement is from the money you put into your retirement NOT from the returns on your retirement.

DEBT RISKS:

American household has 34% of their income going out the back door to pay revolving interest on credit cards, car loans, and home mortgages.

This could be as high as 100K plus!

TAX RISKS:

CPA and Tax Expert Ed Slott says, “Taxes are a larger risk than market crashes.”

If you have all your retirement income in qualified plans like IRA’s and 401(k)’s that require you to pay taxes when you take the money out, you have a huge tax liability.

MARKET RISKS:

A single 20% or 30% market crash can not only hurt your account balances, but it can cause you to run out of money years sooner.

HEALTH CARE RISKS:

Statistics show that long term health care costs can be the largest expense in retirement, what have you done to protect your nest egg and your family from being hammered by this expense?

LONGEVITY RISKS:

Longevity is the great RISK MULTIPLIER. Do you know how long you will live and how that will affect your future income? Hopefully a long prosperous life. Longer life spans multiply the likelihood of this risk happening.

Protect Against These 6 Retirement Risks.

Request a Debt-Free / Tax-Free Solutions Consultation Right Now.

You’ll see how to prepare your retirement against each of these 6 harmful retirement risks.

DebtfreeTaxfree.Solutions

LEVERAGE

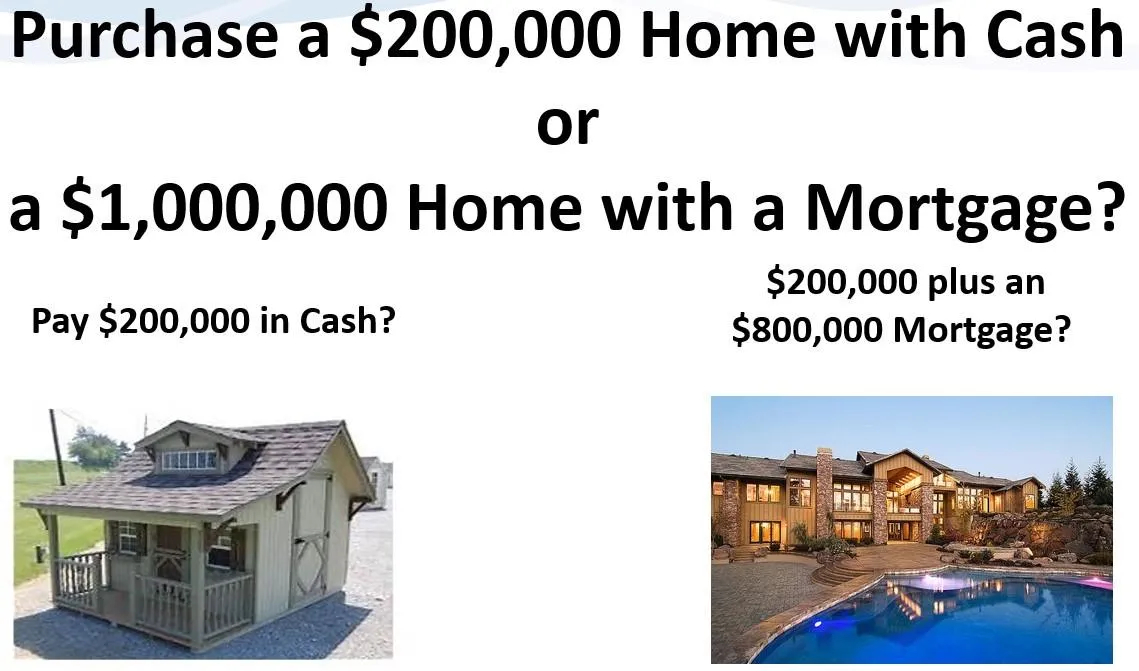

A Revolutionary Way to LEVERAGE Your Retirement!

What if you could use LEVERAGE to fund your retirement, similar to how you bought your house?

Experts suggest toward your retirement years, you should be saving 33% towards retirement. By using LEVERAGE, this could help with Capital Risk.

10% Growth on $200,000 = $20,000

10% Growth on $1,000,000 = $100,000

Now your total value is higher.

BIG HOUSE - BIG RETIREMENT

DEBT ELIMINATION

Do You Want A 34% Raise?

American households have 34% of their income going out the back door to pay revolving interest on credit cards, car loans, and home mortgages.

Let's pay off your home, business loans, credit cards, car loans...faster than you ever thought without spending any more money than you are spending now.

Simply redirecting your cash flow.

(NOT DEBT CONSOLIDATION OR REFIANNCAING)

INDEXING

Take Advantage of Gains While Eliminating Losses.

You can purchase option calls on indexes like the S&P 500. If the market goes up, you can exercise those options to realize market gains (often there are ceiling or caps on your earning potential). These are offset by a $0 floor. If the market goes down in value the options are NOT exercised so you do not lose the value of your investment.

Since your cash value is not actually invested in an index, if the index were to return a negative return, your policy would return zero percent. This 0% floor dramatically reduces the risk profile vs. versus index funds or mutual funds that have full market risk. A 30% loss in the market requires a 43% return to get back to even.

TAX STRATIGIES

Are Taxes The Lowest We Will See In Our Lifetime?

Estimates are that income taxes will double by 2033 (Source: Congressional Budget Office)

Look at the history of taxes after major events. Top marginal tax brackets were at 64% after the Great Depression and peaked at 94% after WWII.

It is not just the marginal tax brackets, but look at what happened to the threshold from 1942 to 1947. Top-end taxes were above 80% and the threshold to be considered "top end" dropped from $5,000,000 to $200,000.

Could this happen after this latest Great Shutdown?

What percentage of your retirement income is tax-free? There are numerous ways to have Tax-Free money strategies.

DebtfreeTaxfree.Solutions

Are You Open To View Wealth Accumulation Differently?

Retire Debt-Free

Leverage Your Retirement

Avoid Future Retirement Taxes

Avoid Market Losses & Crashes

Have Your Money Never Run Out

There is no cost or obligation to talk.

Jason Roll began his career in financial planning, 20 years ago, helping families plan for retirement and college.

He now focuses on a holistic planning model with experts that create a team of specialists. With all the advanced planning techniques, the ultimate goal is simple…creating a debt-free and tax-free retirement!

He graduated from the University of Colorado with a degree in Business Management with an emphasis in Entrepreneurship.

He enjoys the mountain experiences of Colorado with his family (snowboarding, downhill mountain biking, hiking, wakeboarding, fishing, etc.).

What he values the most is his family.

ARE YOU OPEN TO VIEW WEALTH ACCUMULATION DIFFERENTLY THAN YOU HAVE BEEN TAUGHT IN THE PAST?

© 2020 Jason Roll DebtFreeTaxFree.Solutions